Overview

Role

UX Designer

Timeline

08/2019 – Ongoing

Type

Web

Team

Creative Director

Content Strategist

UX Research

Product/Developers

Business

Legal

As a UX Designer, I was responsible for rethinking the customer experience for the Quote and Purchase flow for Renters insurance on the online channel. I did this by first starting by answering the What and Why questions.

Then I leveraged and iterated on business goals, customer behaviors, customer expectations, and of course good design principles.

There are aspects of the project I'm unable to share because of NDA.

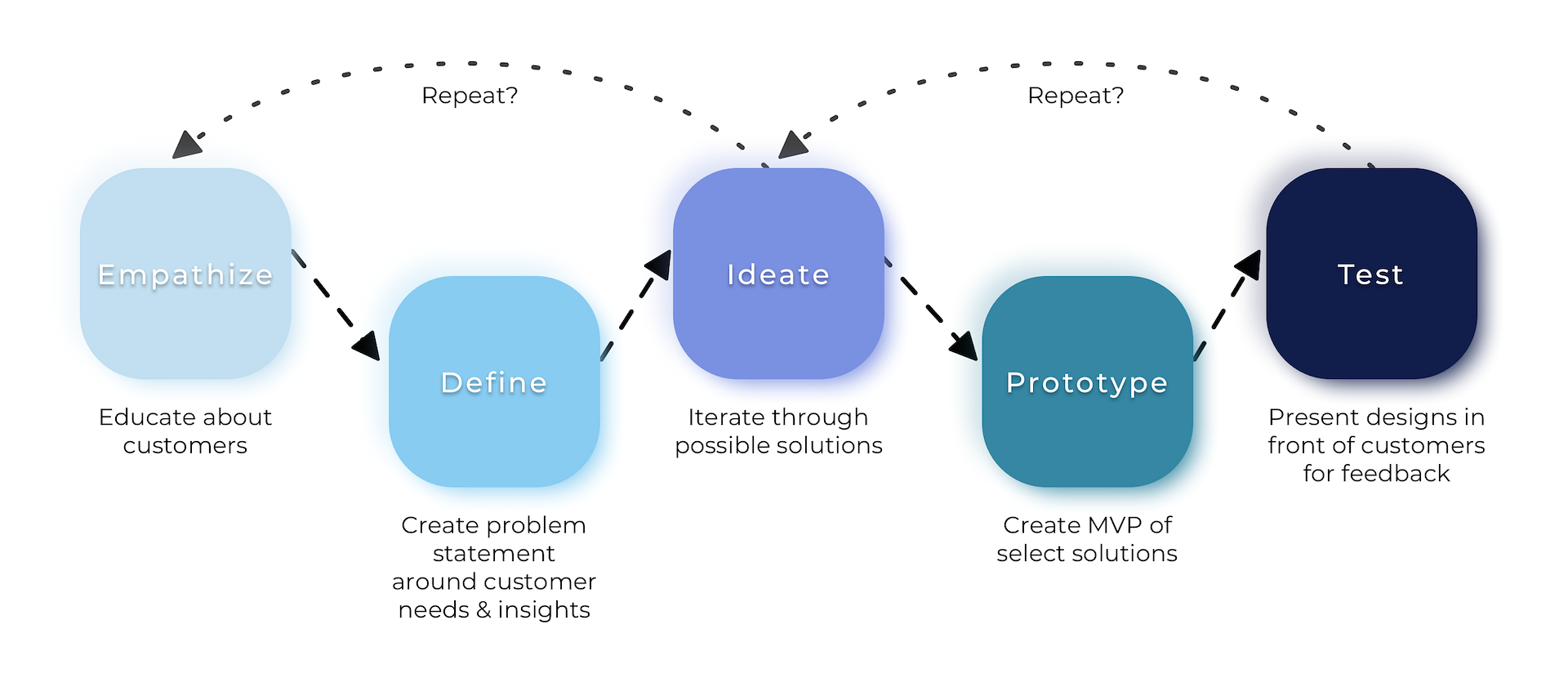

My Process

Problems To Solve

The task was to rethink the customer channel experience using 3 key guiding principles that originated from foundational customer research.

- 1. Easy experience: An 'A' to 'Z' experience that feels more like 'A' to 'B'. (4 min time on task)

- 2. Simplify & Help: De-codify insurance 'jargon'. (59% completion rate)

- 3. Personalize & Tailor: Bring a personal 'neighborly touch' to the overall experience. (4.12/5.0 satisfaction score)

Used research & analytics to help guide the designs, lead conversations and uncover critical user problems

Quantitative example: At State Farm, I used screen dimension analytics to teach others on the importance of mobile-first design.

Qualitative example: Aligned with UX research and user pain points in designs.

Our customers at the forefront

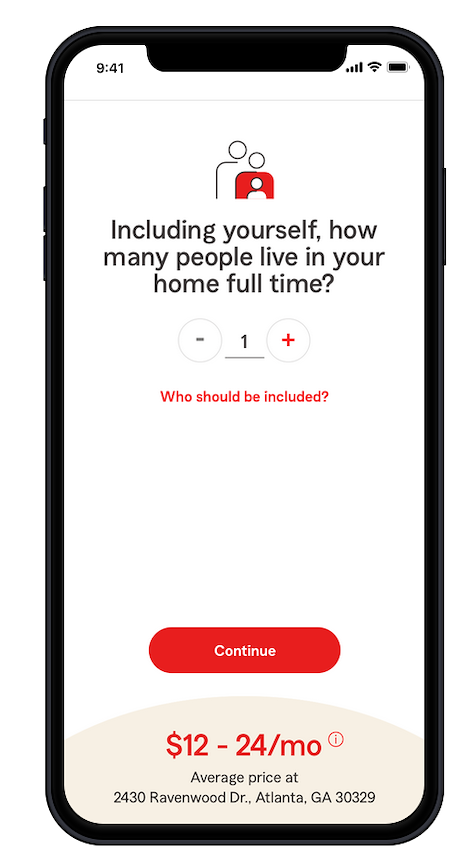

Often times, our customers shop during big life moments. They're expecting a fast and easy experience. For each customer persona, I identified key principles areas of focus for each page in the Quote and Purchase journey.

Megan

- Proof to move in: Price/cost sensitive.

- Needs to understand: Doesn't know much about insurance.

- Consider others: Maybe living alone or living with roommates.

- Multiple Device User: Mobile, tablet, desktop – has it all.

Linda

- Simplify: Knows a bit about insurance.

– Consider flow: Maybe downsizing from a house.

- Need for privacy: Sensitive to personal information.

- Consider limits: Not as tech savvy as peers.

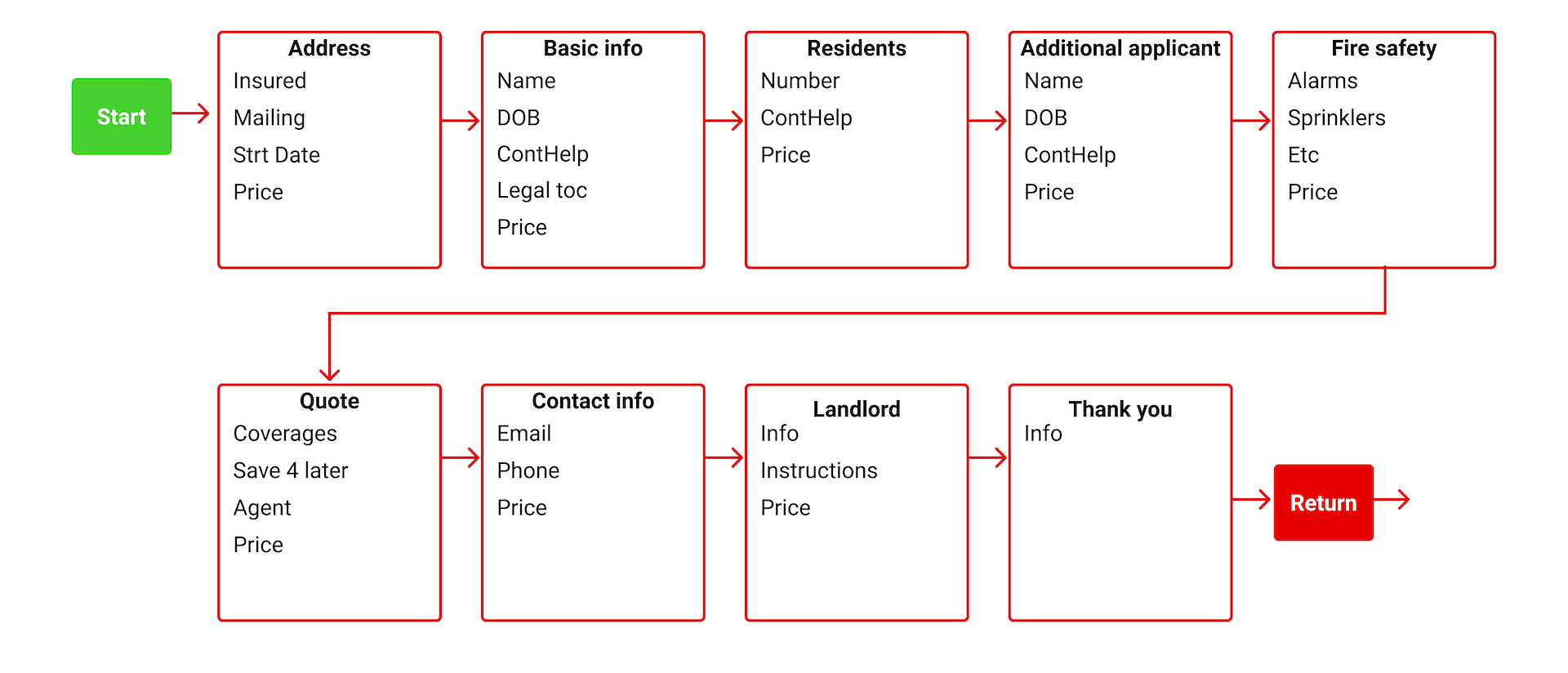

High-level Arch. / Flow

The information architecture helped me identify the important front-end & back-end interactions in the flow to focus on first.

The iterative prototype starts with low-fi

InVision’s Freehand and Mural are my digital sketchpad to gather feedback on ideas.

By seamlessly collaborating with others on Freehand, I sketch out ideas, wireframes & flows quickly to gather feedback from customers and internal-stakeholders.

Freehand Fidelity

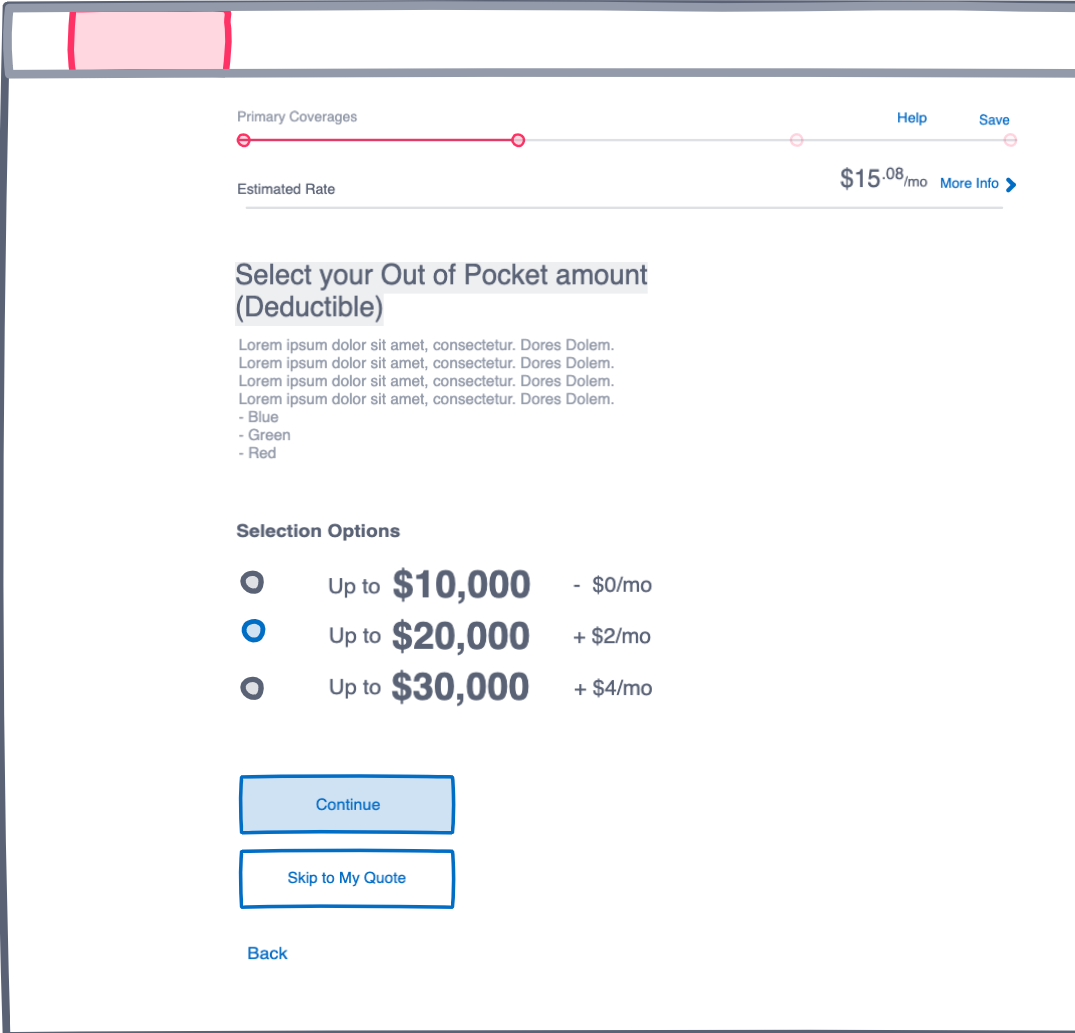

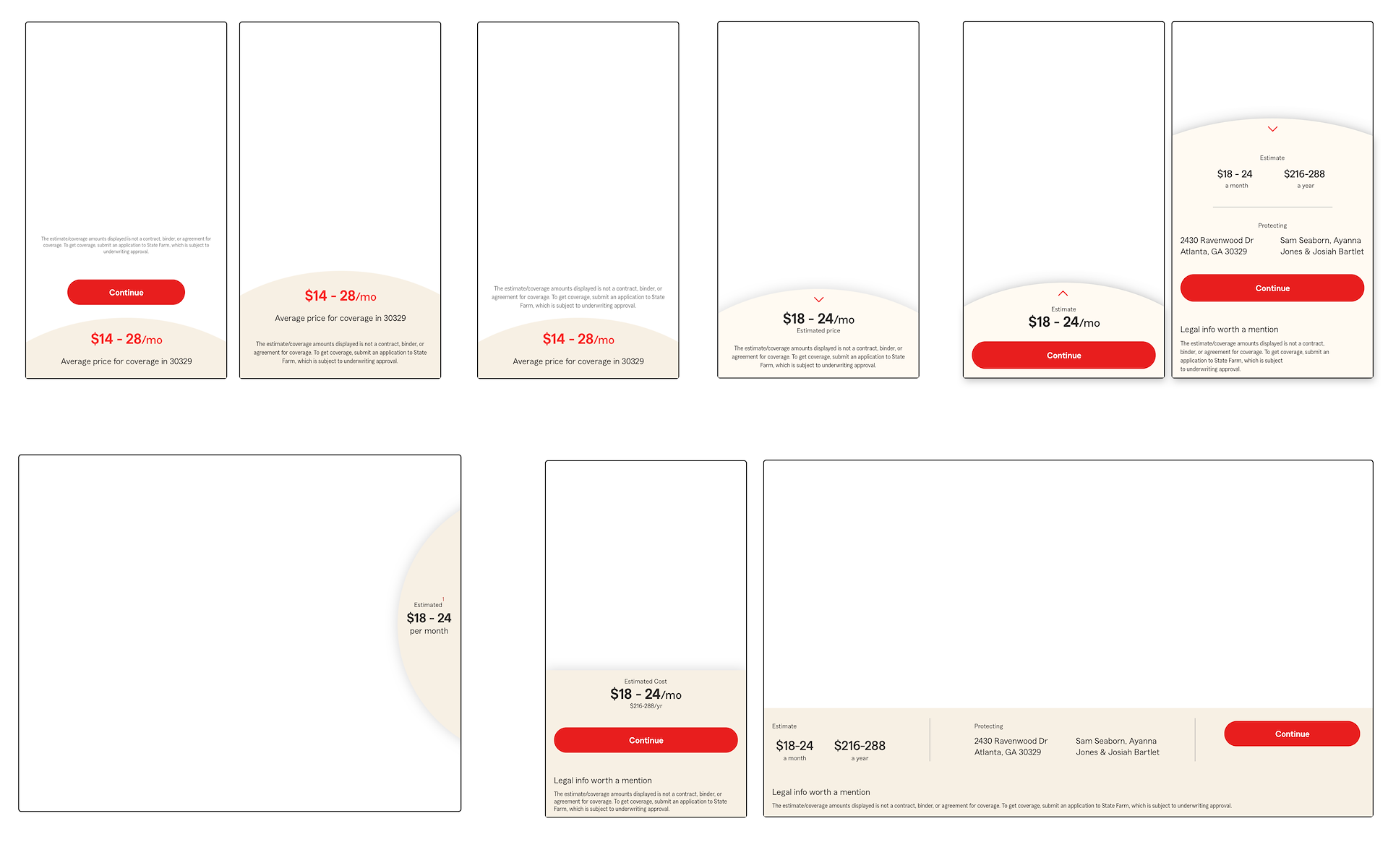

I often started in the freehand fidelity because it allowed me to test and gather feedback on placements, layouts, design patterns, and sometimes micro-interactions.

This is one example of one of many different placements for the price estimate and coverage selections.

One of the biggest reasons I enjoy testing early figuring out the good ideas versus the ones that need extra work. In this case, many users thought the “selling” piece was too cheesy albeit with me thinking it was fantastic.

Test early, test often and test again

Partnered with UX researchers on research goals to create comprehensive plans that tested our hypotheses and expelled our assumptions to prove if our designs worked or not.

"I've learned more about insurance in the past 15 minutes than in my 3 years of being with current insurance provider." – Usability test participant

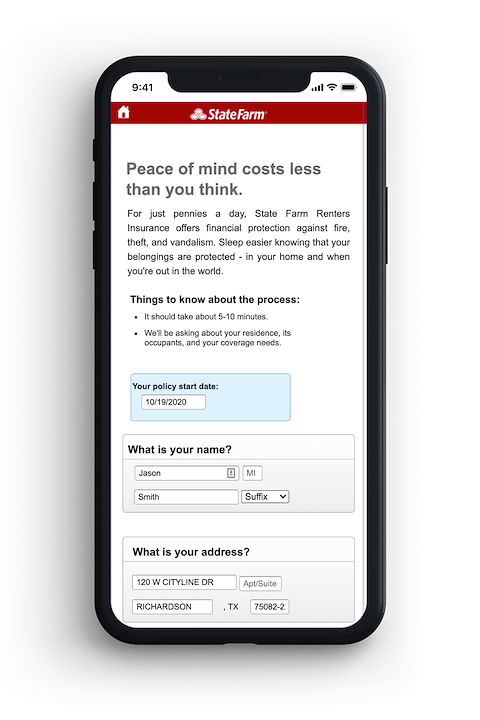

The Old Experience

The old experience had its goals led primarily by archaic insurance forms that had closer resemblances to doctor office forms than anything customer friendly. One of the biggest issue was information overload.

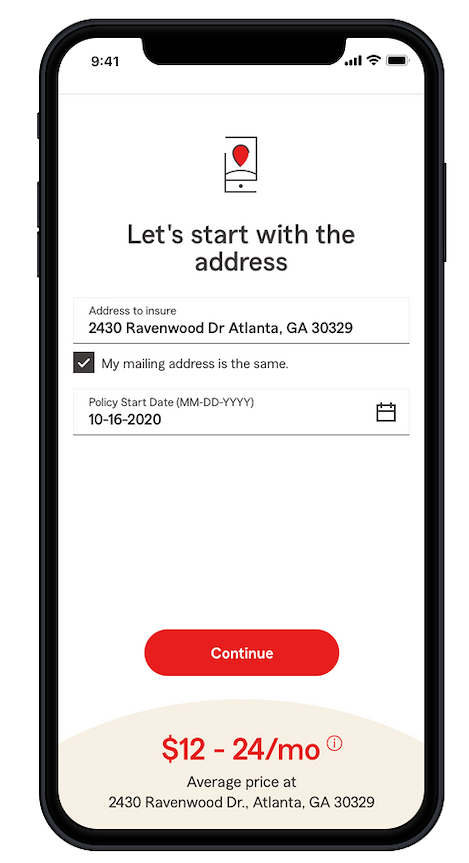

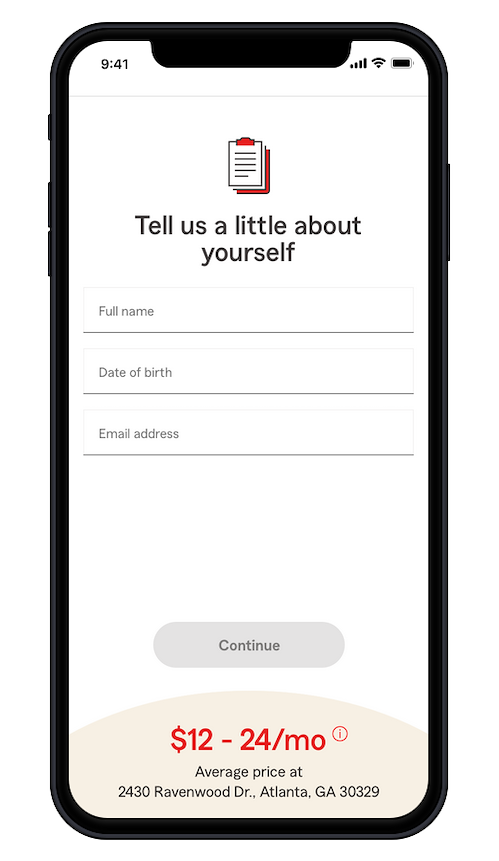

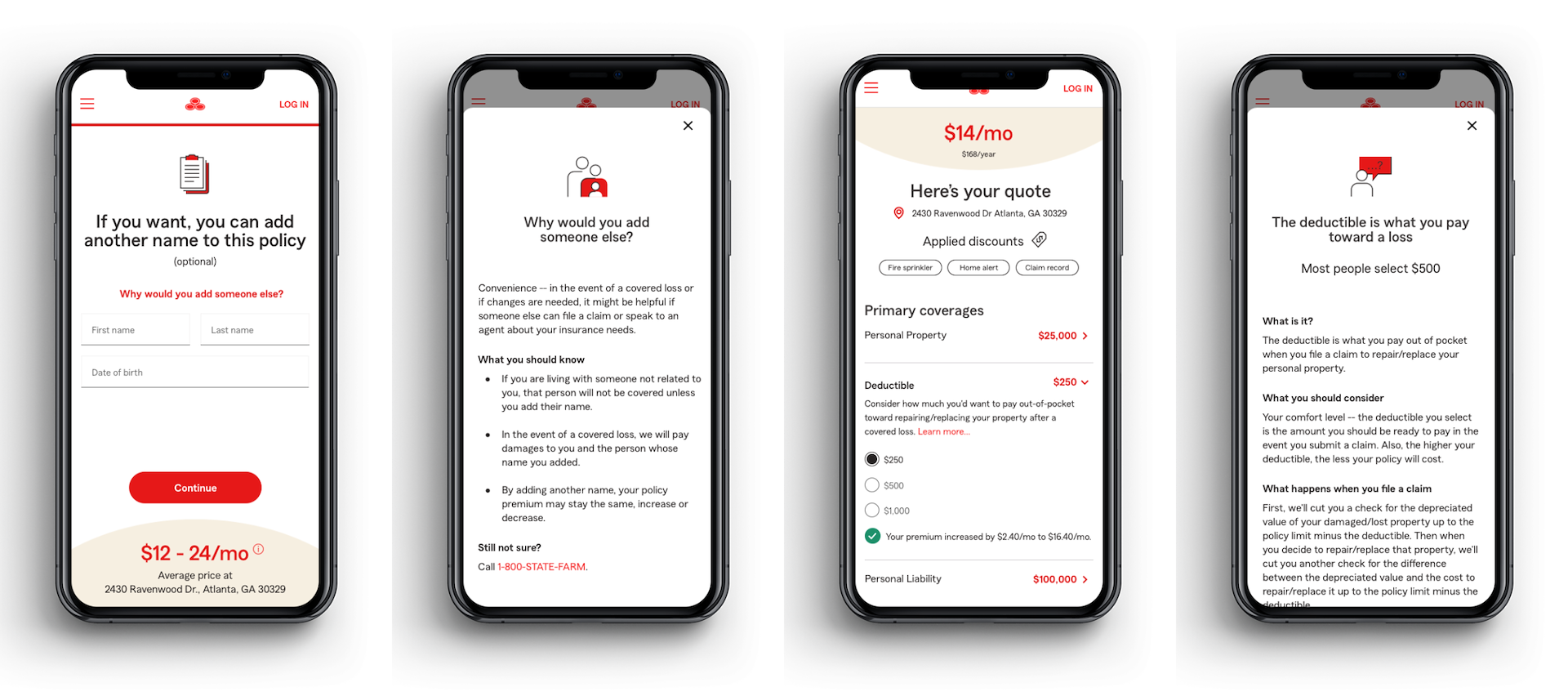

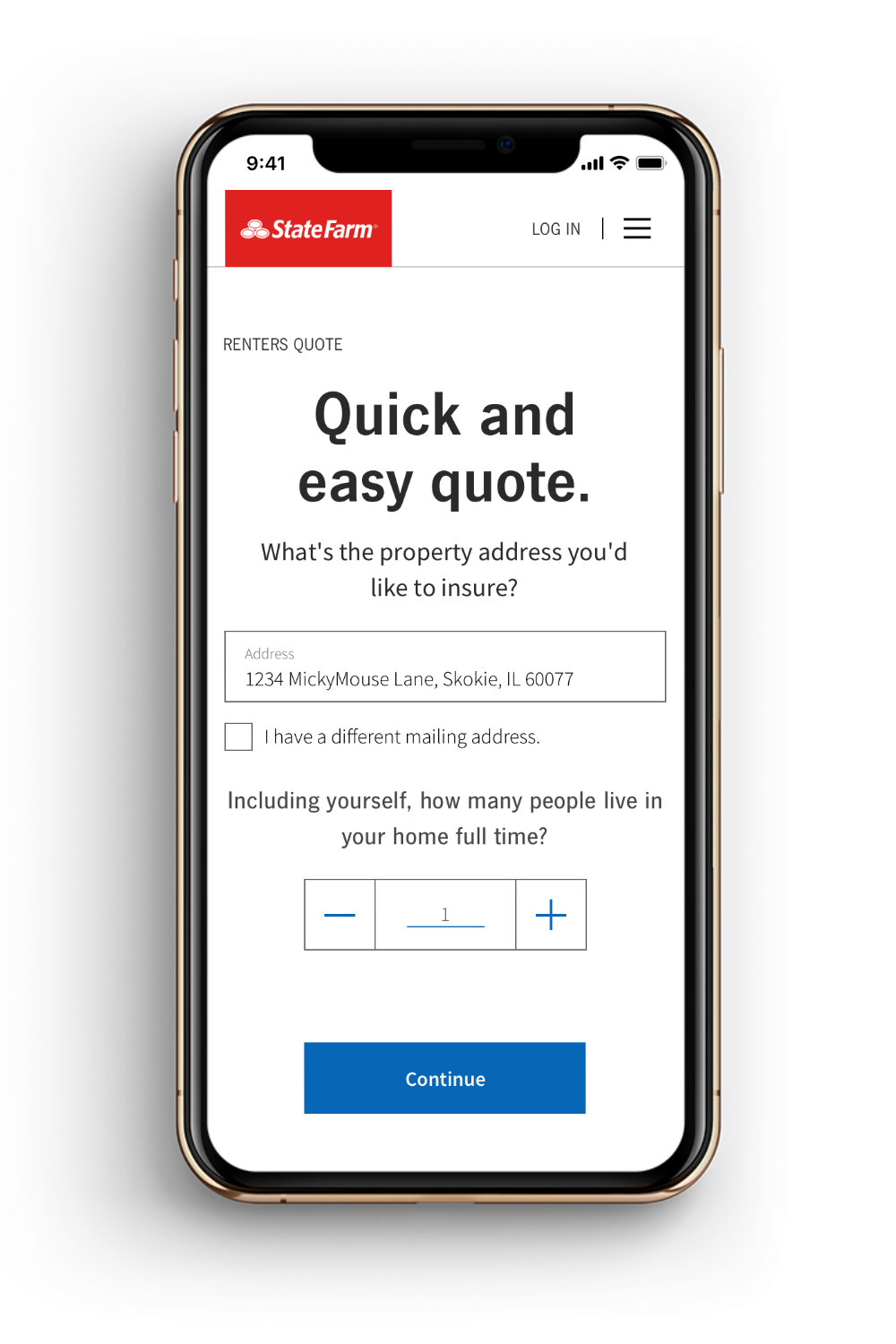

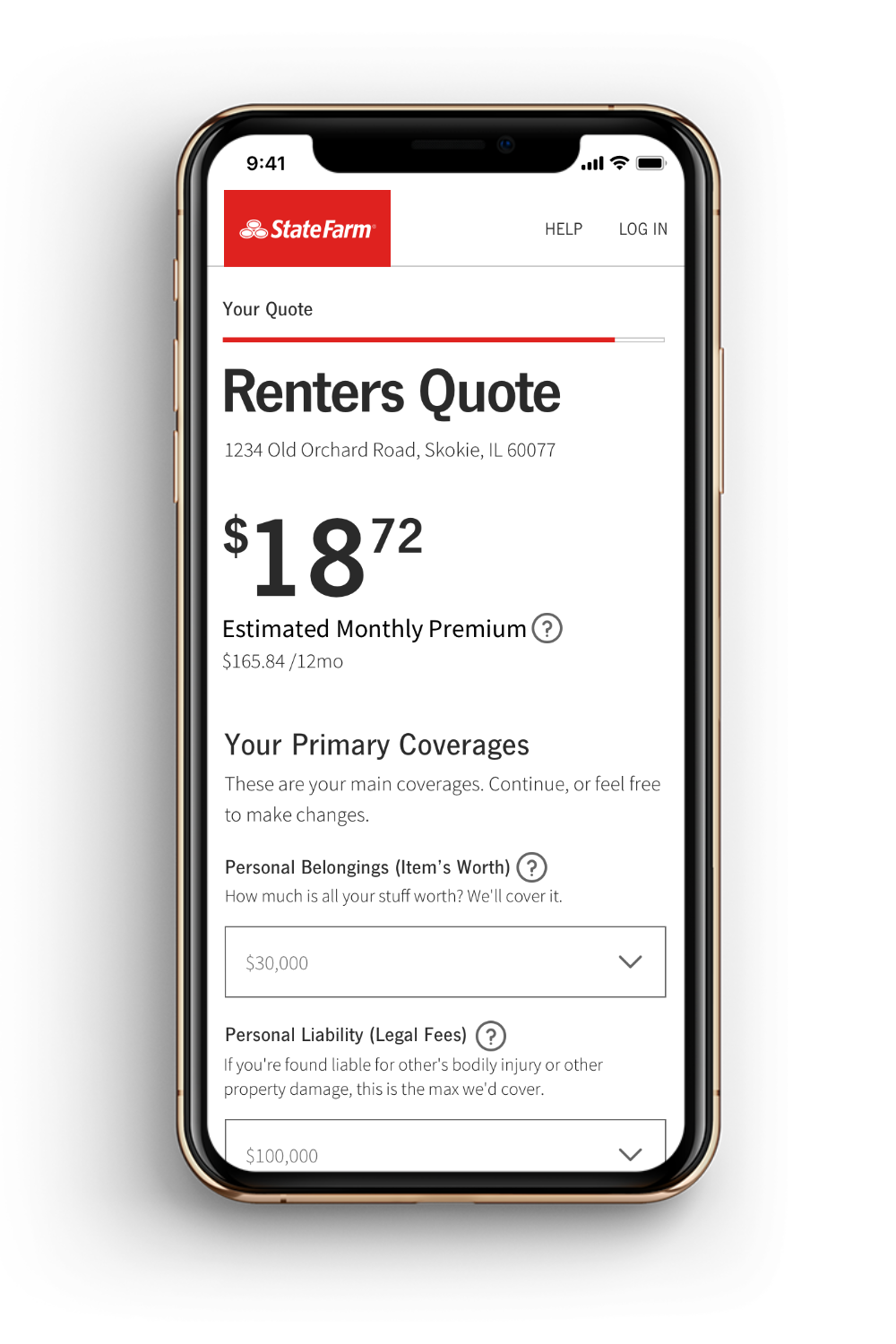

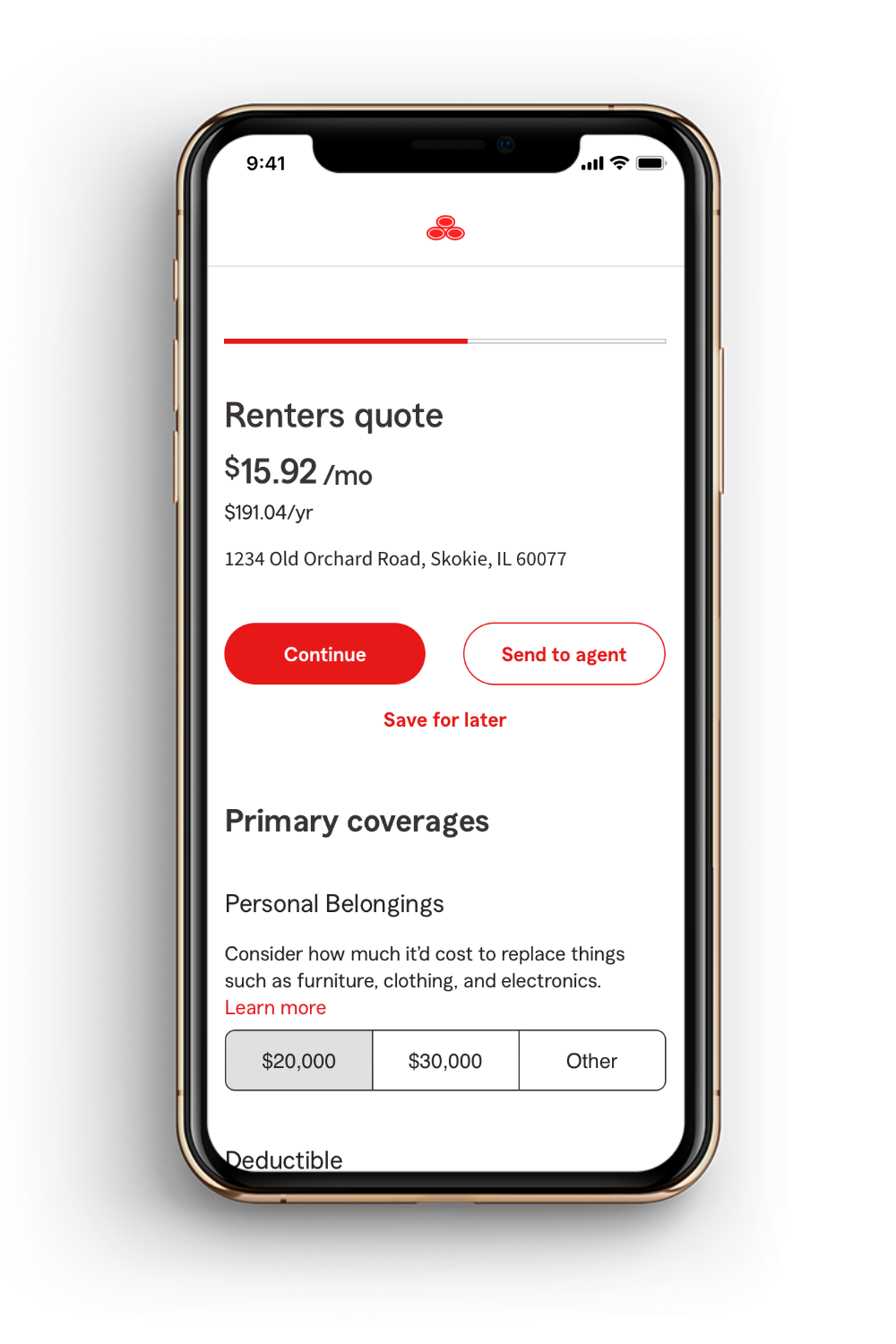

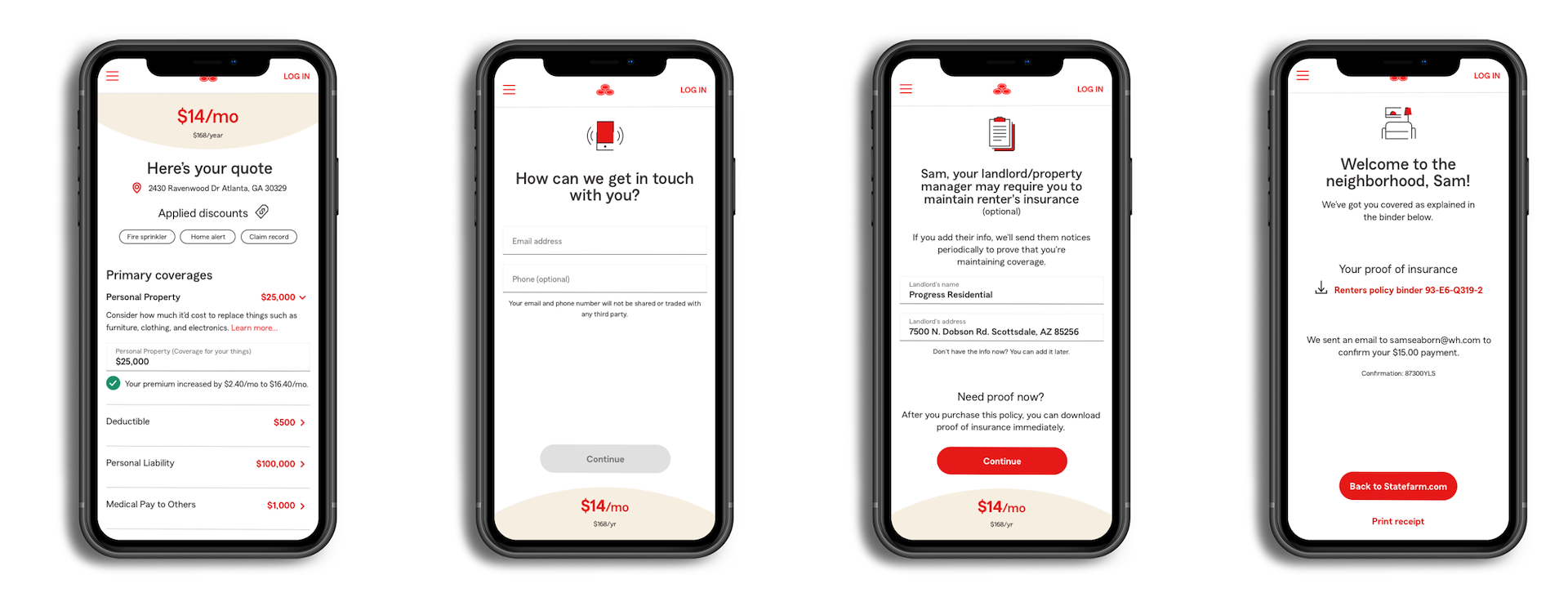

The New Experience

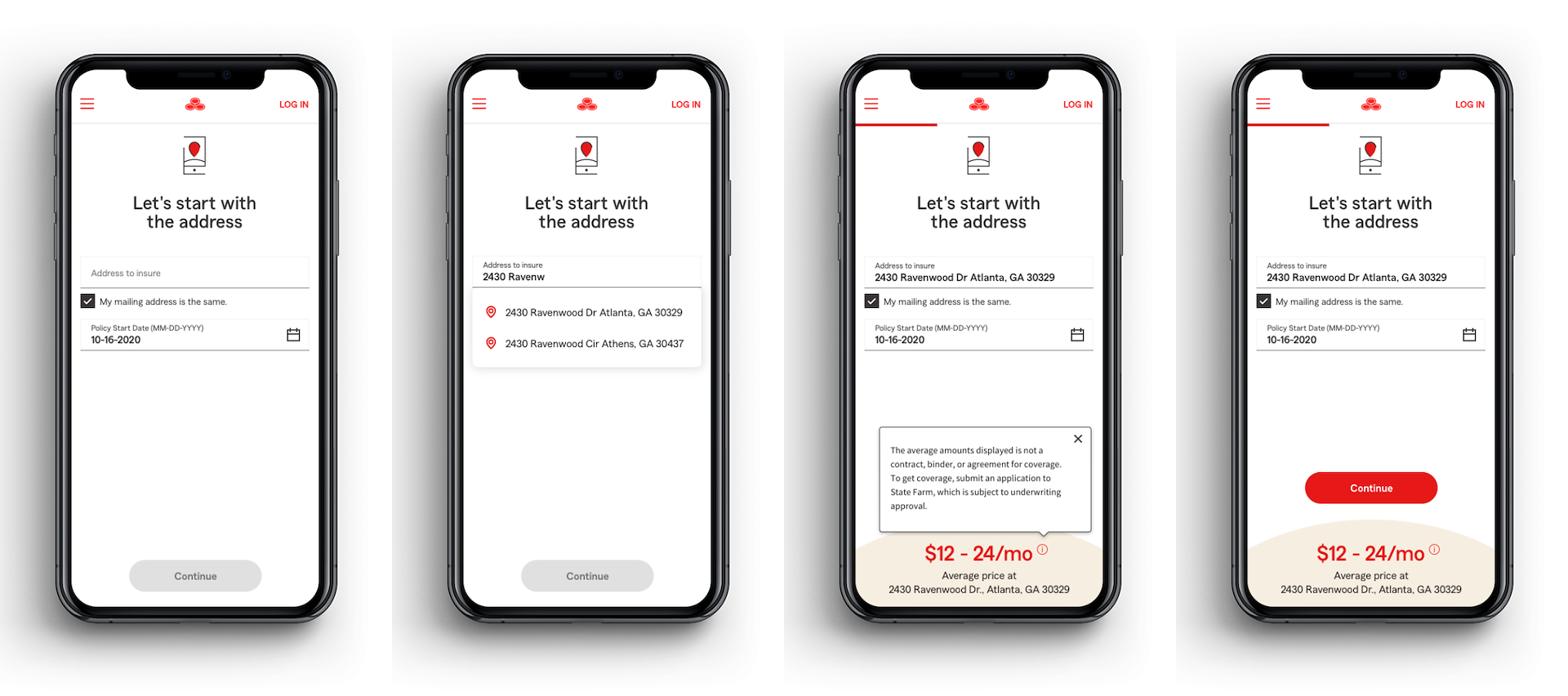

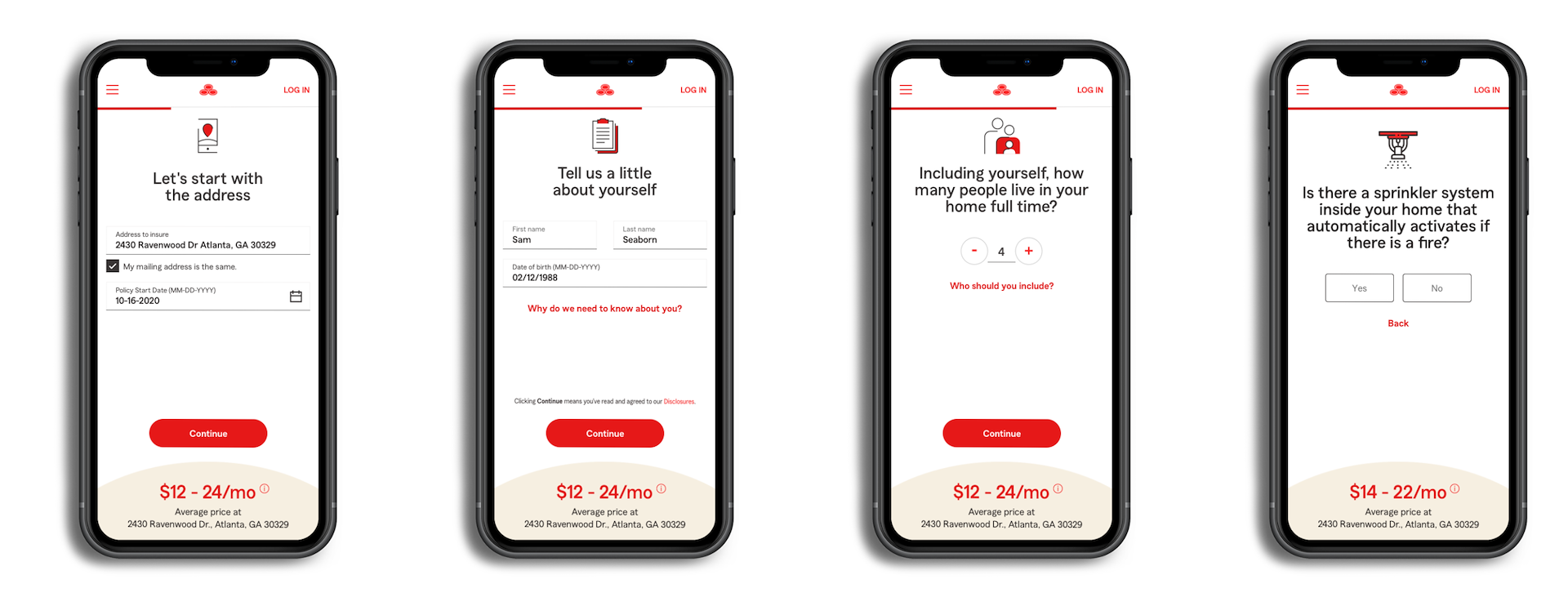

The primary goal for the new experience was to lead the experience with the customer at the forefront. Only ask what is important, at the moment.

Principles In Action

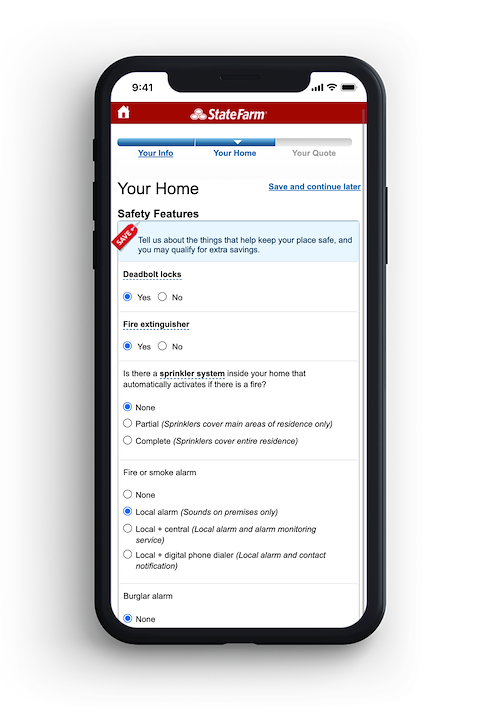

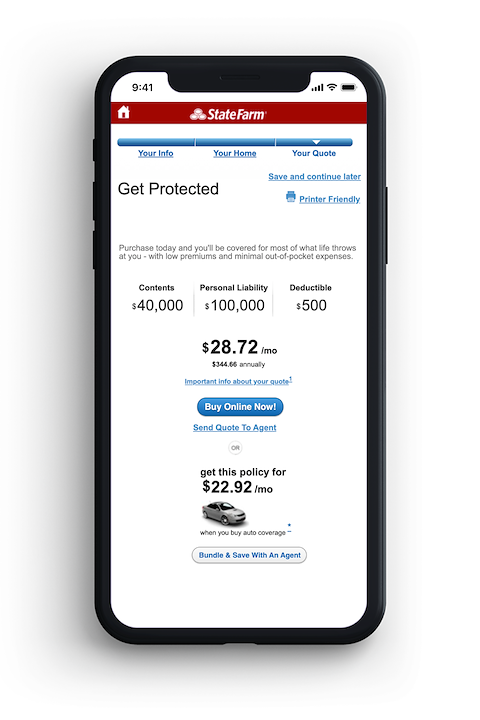

- Buttery Smooth Experience

We know our customers window shop – but often times they’re hesitant to start or they quit early due to misconceptions or confusion.

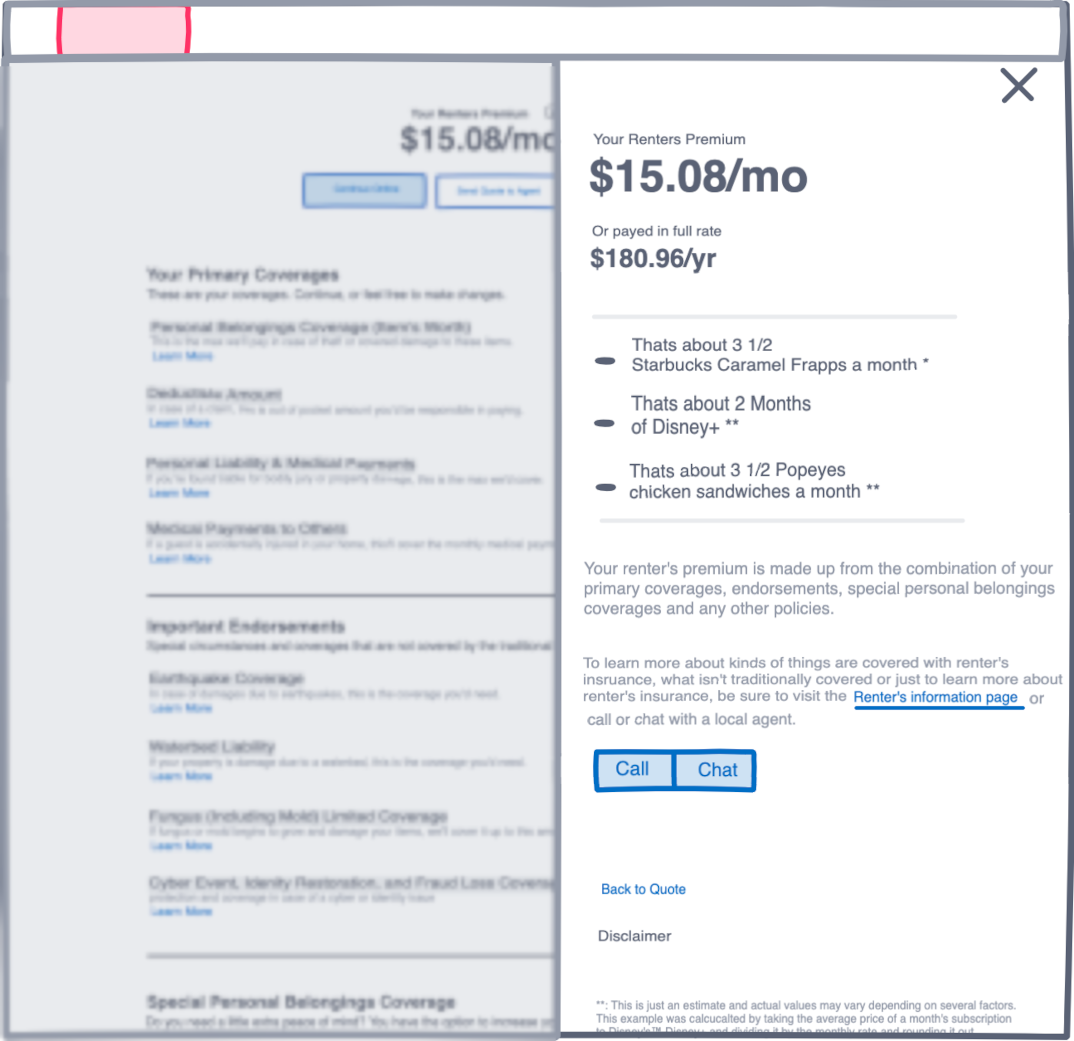

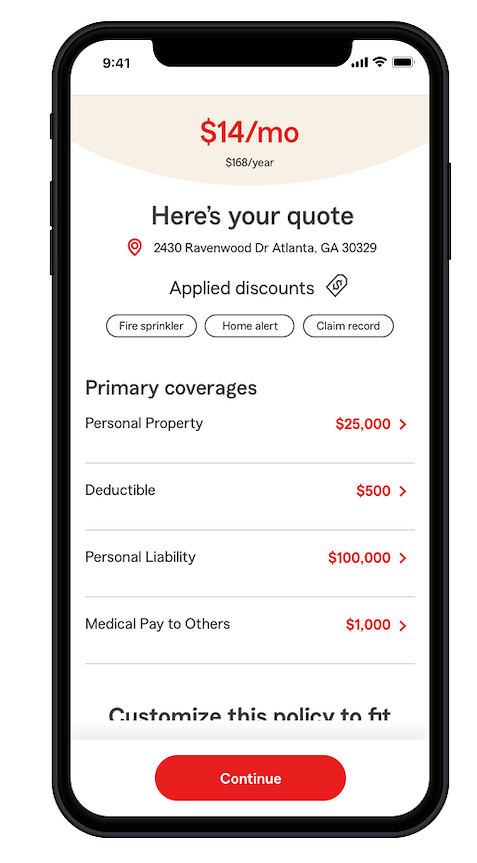

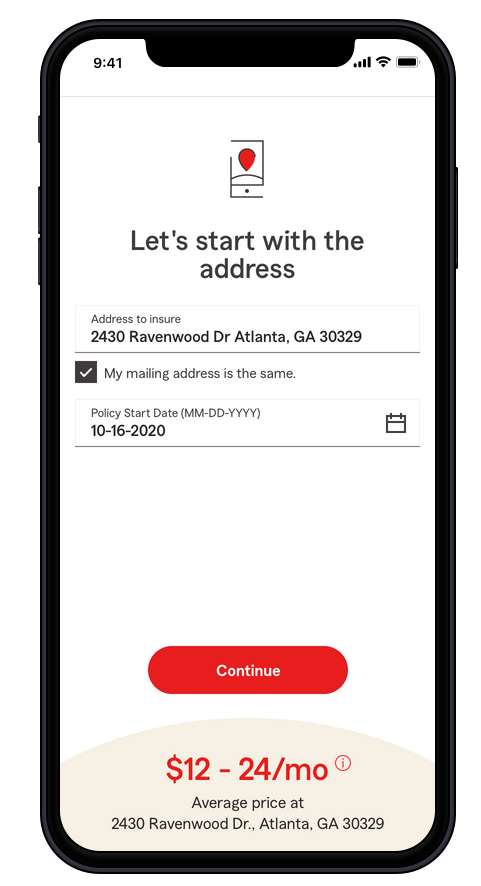

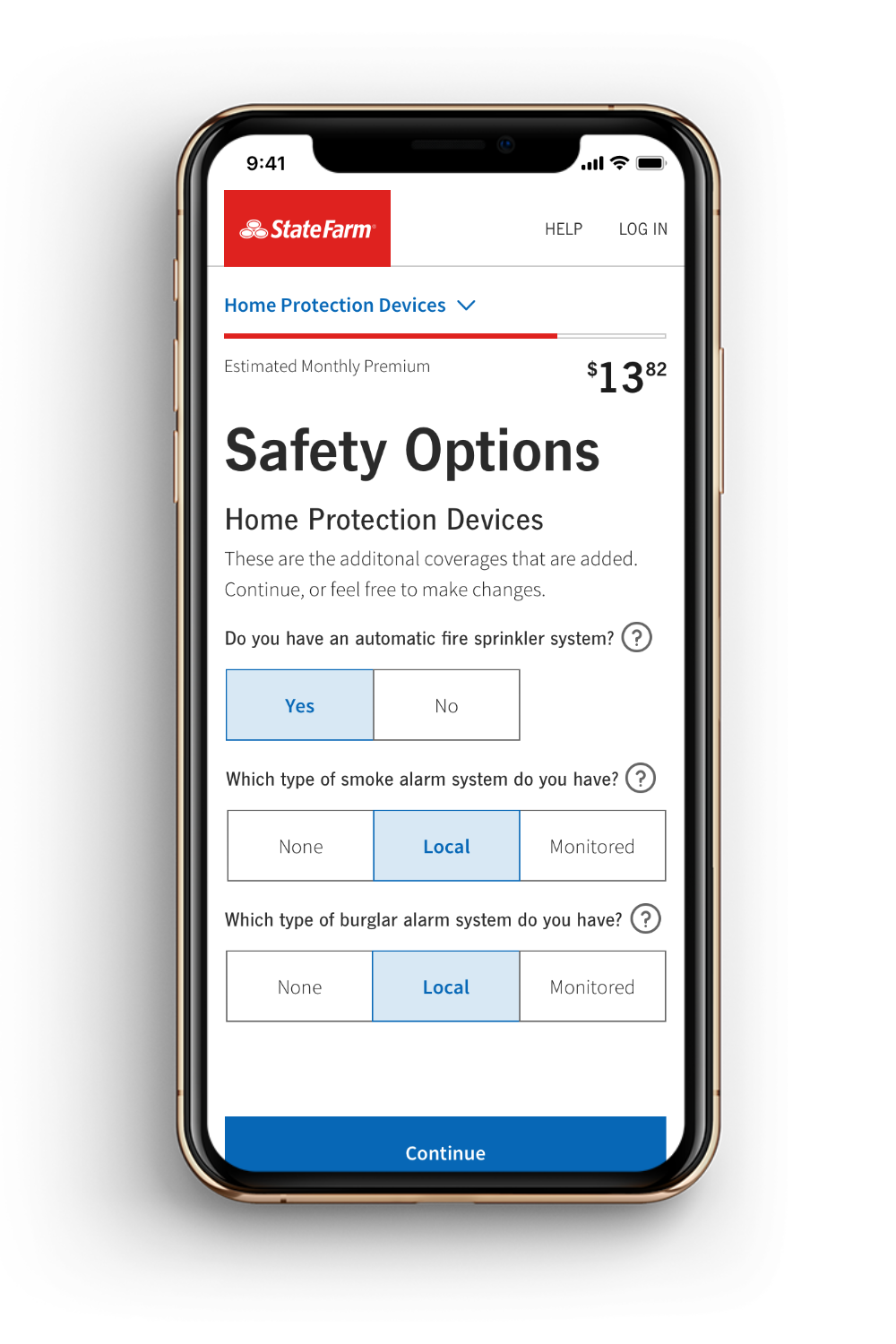

When compared to the previous experience, our customers received an estimate from the start. This was a huge win because many people have the misconception of renters being too expensive.

Even though on paper there are more screens, users worked faster due to the the simplification, lower cognitive load and the lack of fluff.

Additionally, the price horizon was created to clearly show the low price which also met internal legal & business stakeholder's requirements.

Disclaimer & Horizon Iteration

There were a lot of conflicting constraints I had to consider when creating something as simple as a price bottom horizon.

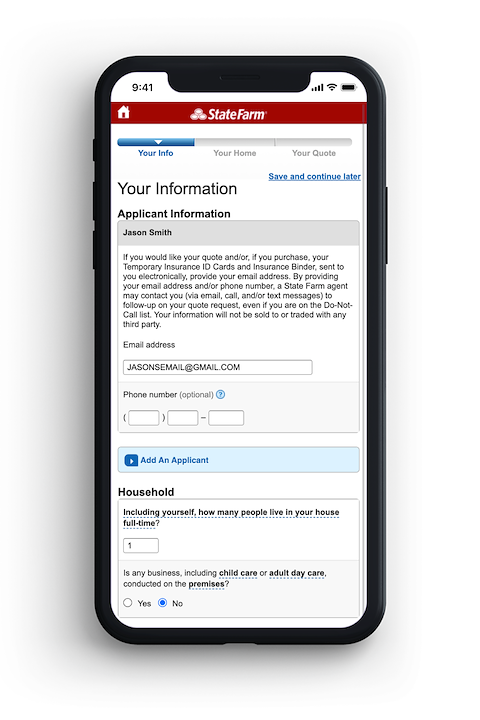

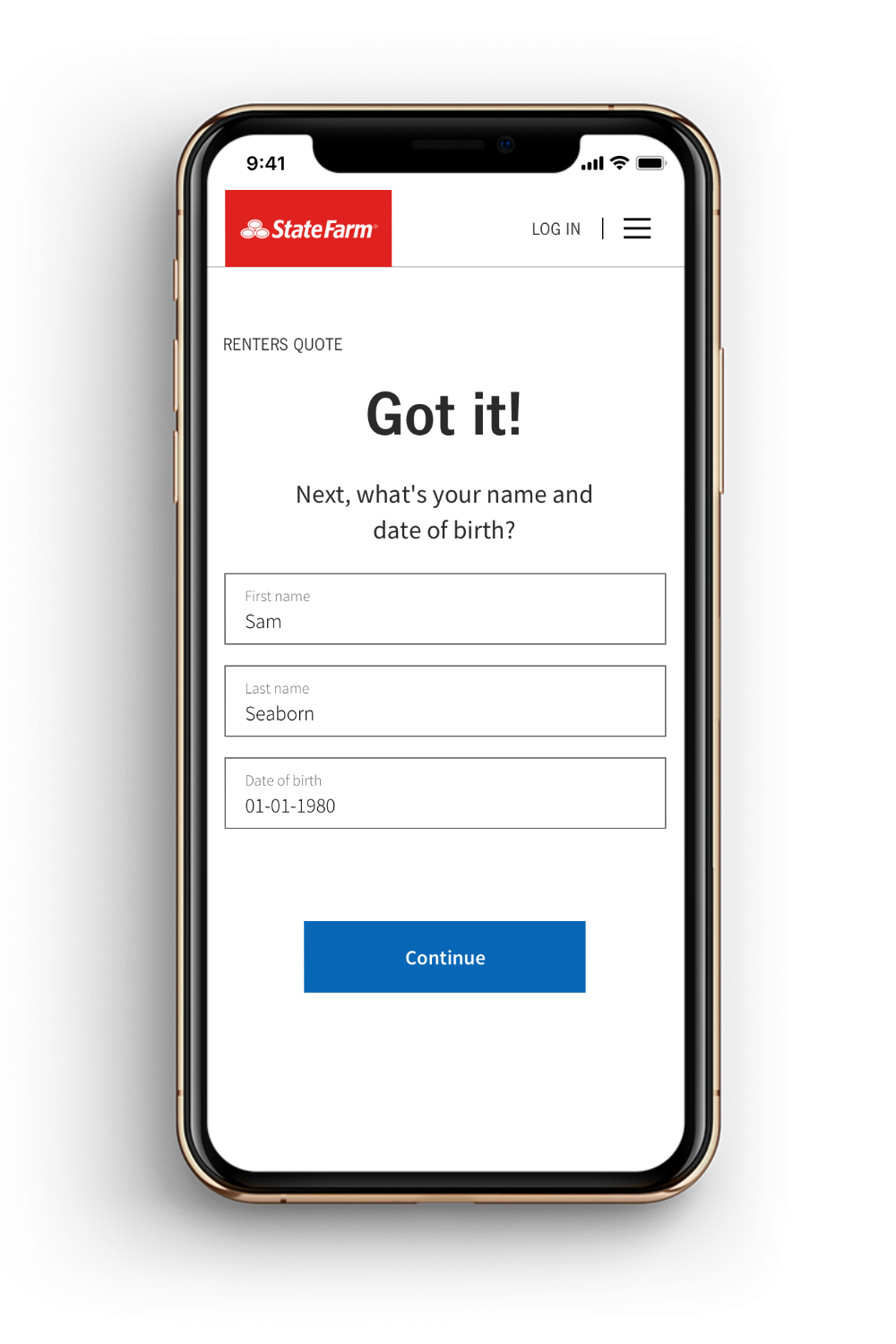

- Conversational Design

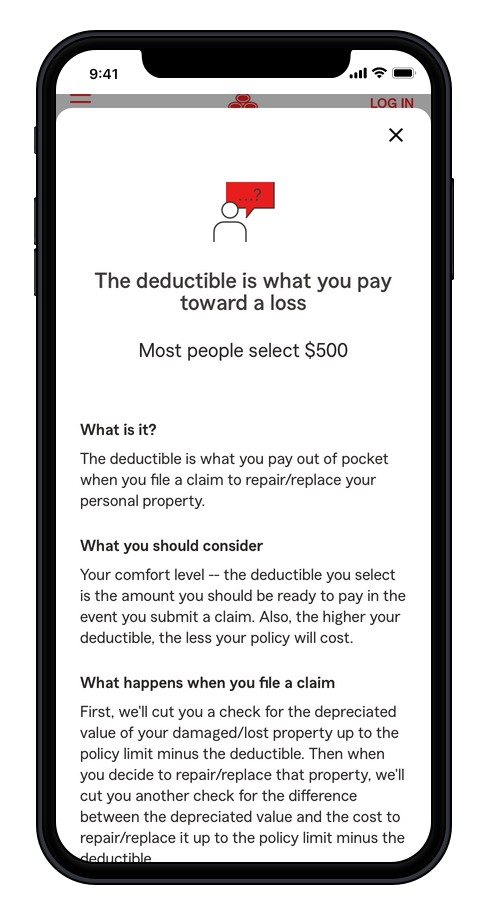

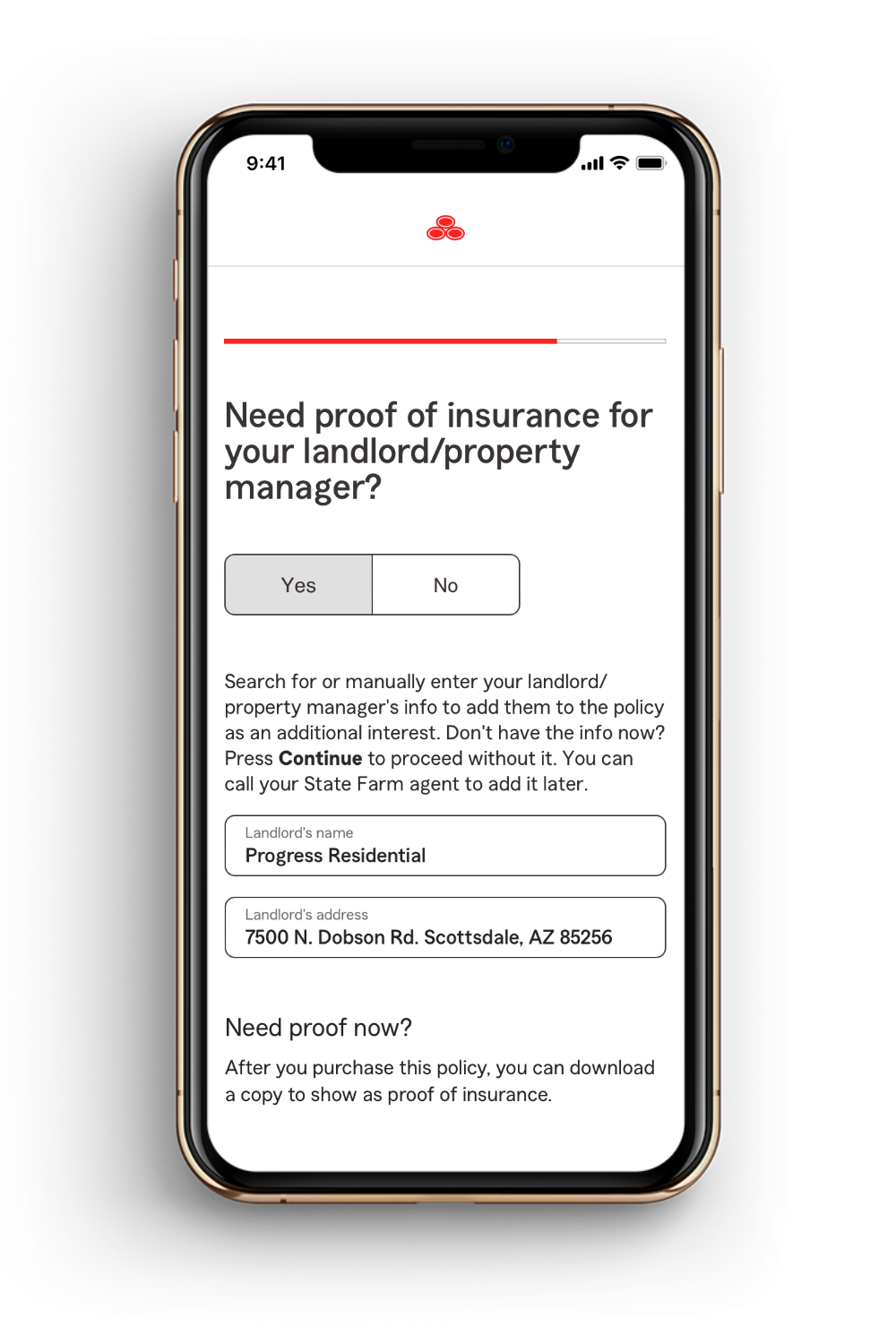

One of the biggest pain points was a lack of understanding of common insurance terms.

This was one of my favorite parts of working on this project because when I explained things more clearly, customers trusted us more.

I spent a lot of time iterating through solutions for those moments of uncertainty that customers had during their journey with friendly reminders.

By working with an incredible content strategist, I was able to transform complicated legal terminology into easy to digest language that anyone can understand.

Contextual help information makes the insurance jargon easy to understand and allows a moment to build trust.

- The "Good Neighbor" Design

At the end of the day, the experience needs to meet customers where they’re at, online, in person, or over the phone.

Our customers expect a personable experience, like sitting inside an agent’s office.

One of the ways I did this was the use of fun loading screens that provided moments of delight and peace.

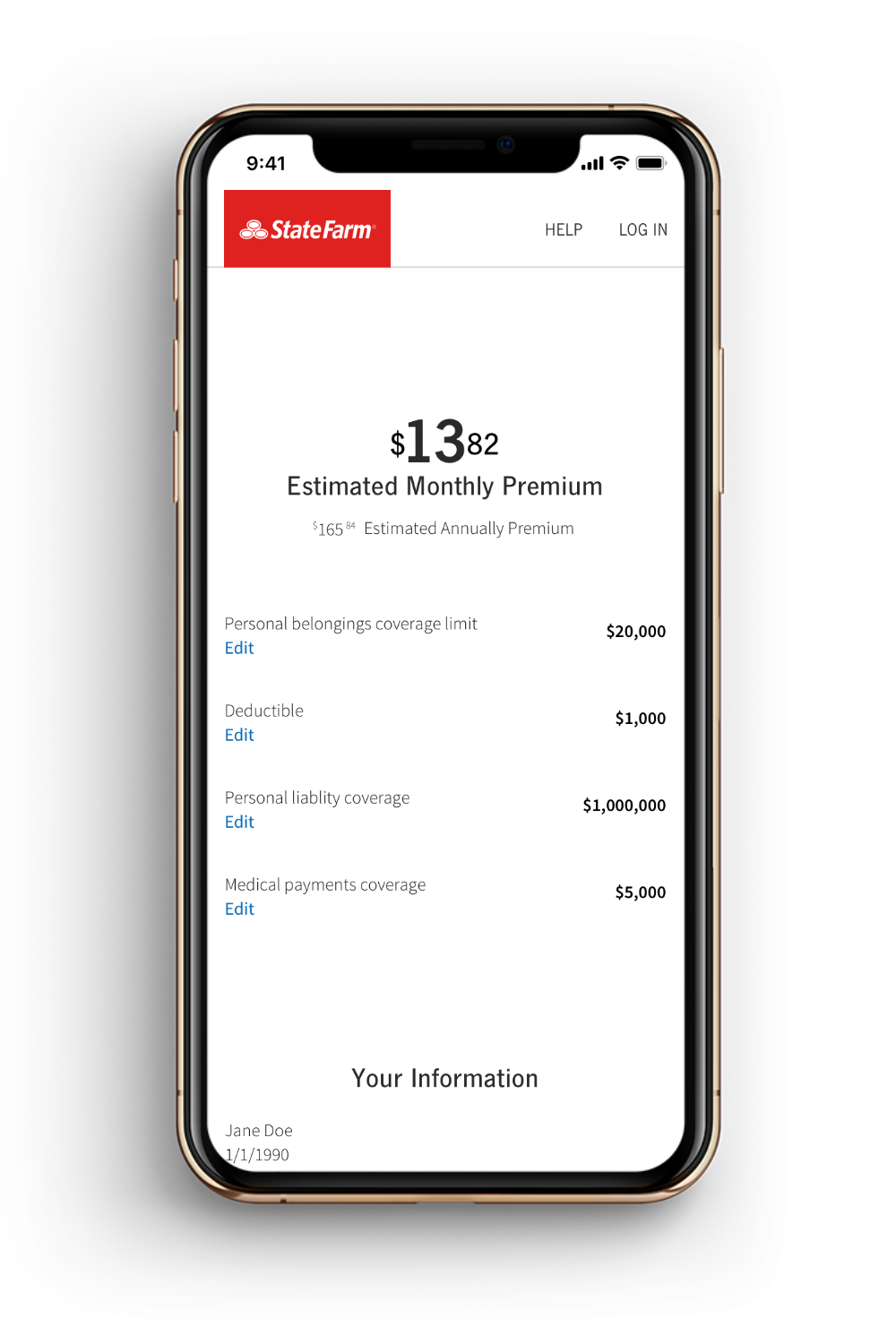

The iterations evolved with new test results, new design systems and new organizational goals.

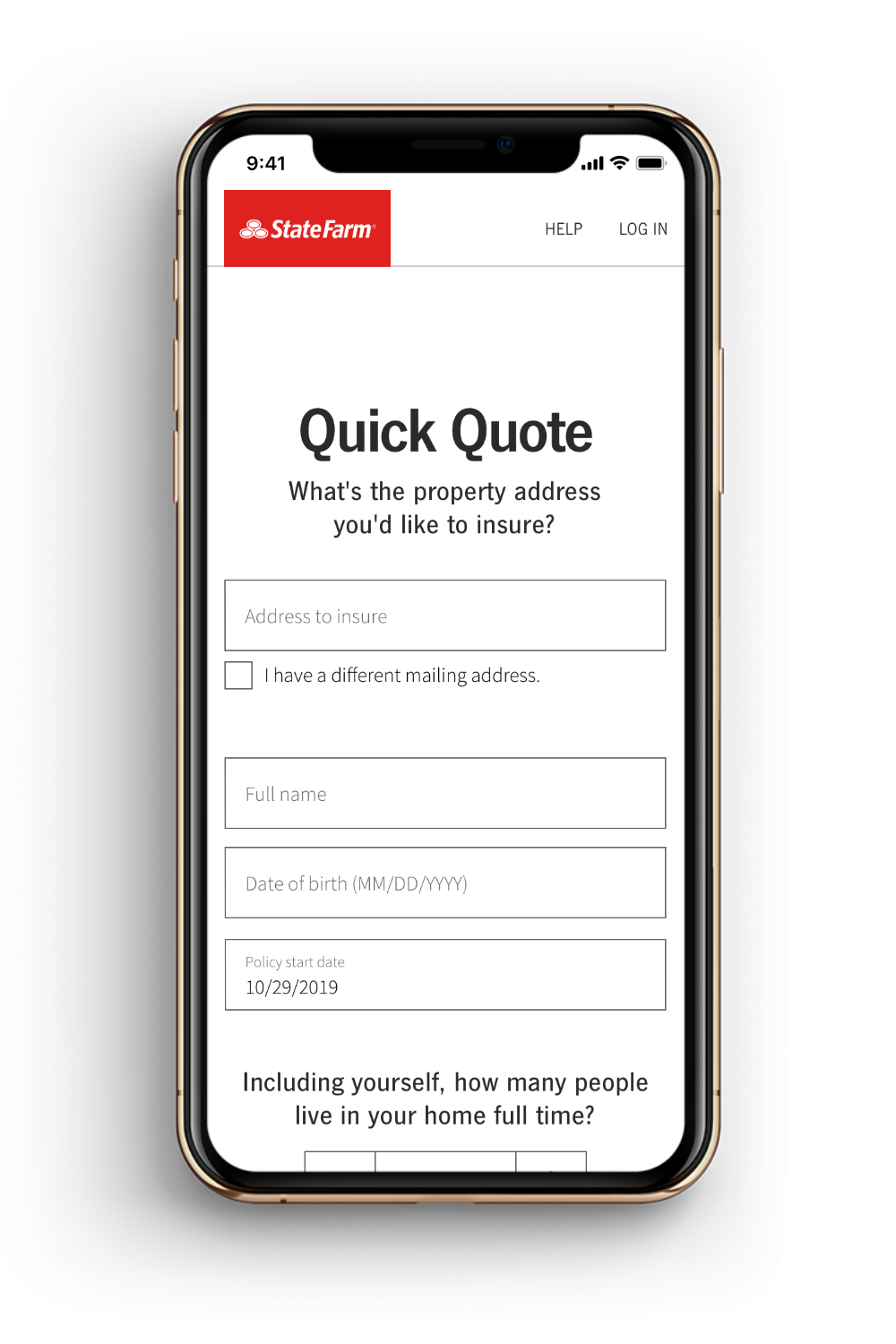

This version consisted of using a singular page with all the questions required before we showed a price.

Once we showed a price, customers would have the freedom to customize their quotes as needed.

Often times, we’re able to simplify the screens even further by pulling questions out or moving them further in the flow.

This is an example of spreading questions and introducing fun immediate conversational language as the customer proceeds.

Due to legal limitations- naming conventions for questions are solidified before design. Fortunately, there is contextual help.

Here, I focused on making common insurance jargon even clearer to make buying insurance clearer, transparent, and easy.

Sometimes design language changes and it was up to me to decide how the new design style impacts the interaction of the pages/questions.

Other times, new questions and requirements are set and it is up to me to insert those items into the current user flow.

The new "simplified", "jargon-friendly"

"neighbor-approved", Renters Quote & Purchase experience.

Conclusion

- Overall, my designs made the flow 30% faster and users purchased 5% quicker.

- The straightforward language and improved simplified UX led to an increase of at least 5% quote completion rate and more than 6% more purchases.

- Improved the satisfaction from 4.12 to 4.70 out of 5.0.

- As of March 2021, many parts of this project have yet to launch so I cannot discuss those parts for now.